In the first quarter of 2023, independent comparison site Finner.nl once again mapped the returns of the average Dutch asset manager. As stock prices recovered, everyone showed positive returns. But who did better? Stoic, or the rest of the Netherlands?

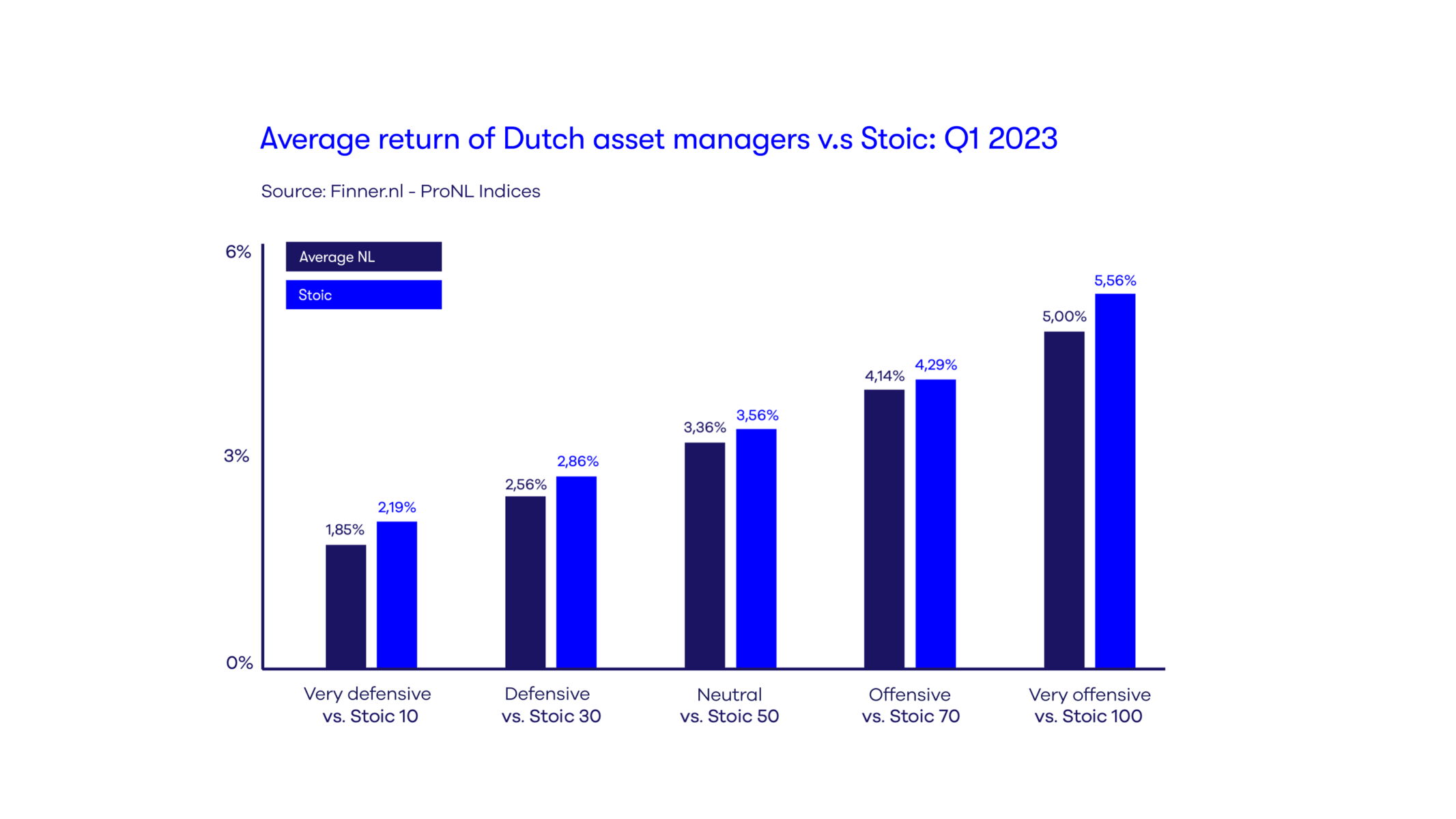

It’s going to be a bit the same story as here, here, here, here and here. But even after the end of the first quarter of 2023, it turns out that Stoic is once again doing better than the average Dutch asset manager. You can see that in the chart below, in which we compare our returns with the Pro NL Index from Finner:

So Finner’s Pro NL Index shows the average return of all Dutch asset managers per risk profile. Since we at Stoic have been making this comparison, we have performed better than the average Dutch asset manager. Consistently.

Undoubtedly there are asset managers who, in this quarter, individually achieved a higher return than we did at Stoic. Congratulations to them. Only: no one is able to make exactly the right predictions consistently, year in, year out. So a fantastic return this quarter will undoubtedly be offset by returns in other quarters that are much less good.

However, at Stoic we do consistently perform better than the rest. Our investment philosophy works. And that’s because it is not based on making predictions about the stock market, nor on gut feeling. Our approach is purely based on facts. And those tell us that prices bounce all over the place from day to day, but that the world economy always grows in the long term. So we always diversify the equity portion of your portfolio across all stocks worldwide. And then we leave it alone as much as possible. That is not only good for your peace of mind, but also for your money, as has been shown time and again.

But what if it turns out we have arrived at a historic moment in time when the world economy no longer grows but actually shrinks? Of course, you would also incur losses with us then. Only, everything around you would also become cheaper. So you are still protected against loss of purchasing power. In this blog post we explain exactly how that works.