(Note: Here you can find the blog with the 2021 returns.)

Due to the coronavirus pandemic, 2020 was naturally a very turbulent year. In March, the stock markets plummeted: a drop of over 37%. But the recovery was also lightning fast: on December 29, 2020, the AEX, for example, was already above 633 points – its highest point in the past 20 years. A year with so much activity on the stock market should, in principle, be advantageous for active investors. But the reality tells a different story.

Logic dictates that active investors should benefit from a volatile market. Because the more volatility, the more you can make a difference as an active investor. After all, the goal of the active investor is to "beat the market," while the passive investor simply follows the market by doing nothing.

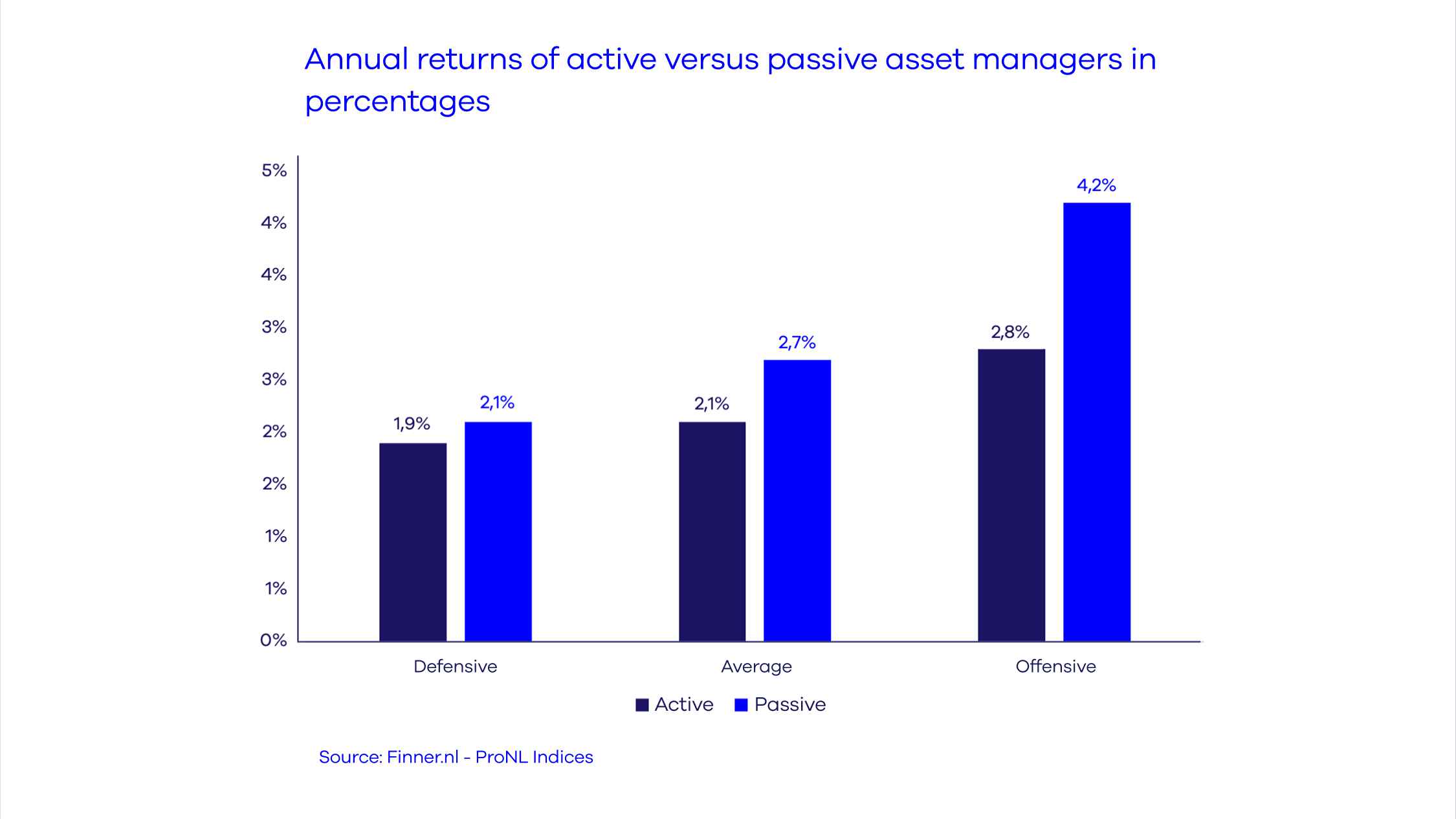

In this article, asset management comparison site Finner compares the 2020 annual figures for Dutch asset management. And it turns out that passive truly outperforms active. In defensive, neutral, and offensive profiles, "passive" asset managers outperformed active managers on average in 2020:

As you can see, the aggressive profile even shows a difference of 1.40%. That doesn't seem like much, but on a portfolio of, say, €500,000, that's still €7,000. And let's not forget the compound interest effect: you'll also earn a return on that €7,000 the following year (all things being equal, of course).

In short: the asset manager you choose makes a significant difference. This is also evident from Finner's absolute figures. On an annualized basis, the lowest recorded return for a manager in 2020 was -8.32%, and the highest return was 9.41%. Calculate your profit. Or loss, of course.

Stoic's returns compared

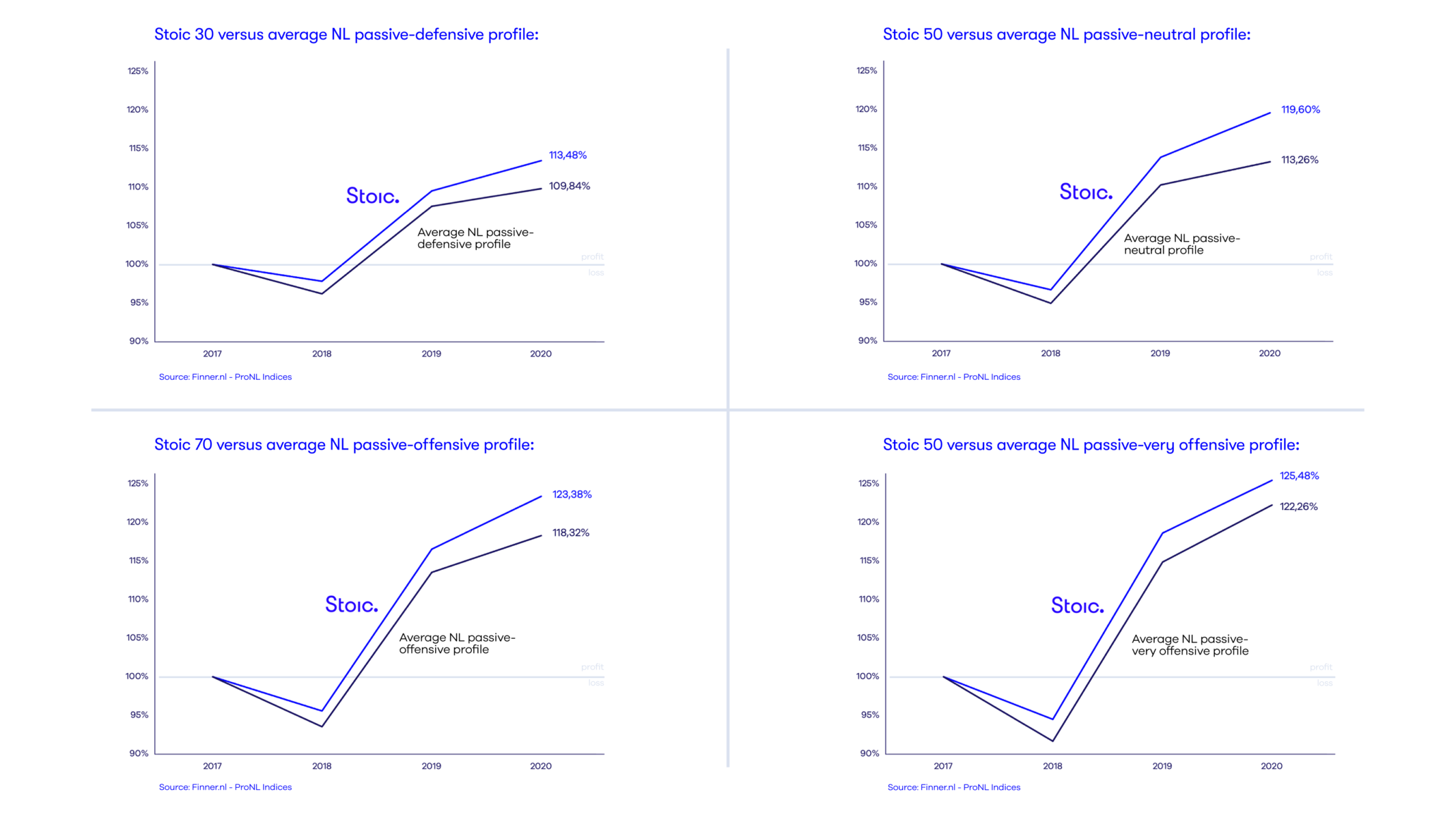

How does Stoic compare to the rest? In the overview below, we compare the returns of the Stoic investment profiles with the average returns of Dutch passive asset managers over the past four years, including the latest figures from 2020, based on Finner's Pro NL Indices. And we see that Stoic consistently outperforms the average Dutch passive asset manager:

Why is that?

In our view, many passive asset managers aren't truly passive. They choose, for example, to invest in a specific index for the long term, without constantly entering and exiting: that's why this is called 'passive.' But the very act of choosing a specific index is, in our view, a 'predictive' choice. After all, they're betting that the chosen index will outperform another index.

At Stoic, we deliberately don't make any choices. We diversify your money across the entire global economy, simply because, in our view, 'predicting' is completely pointless. And that simply proves to be the best investment for your money.

- In this article, you can read more about the difference between passive investing and what we call 'Calm Capital Control.'