The independent asset manager comparison site Finner.nl recently published its ProNL index figures for 2021 in this article: the figures represent the average annual returns achieved by Dutch asset managers in 2021, after deducting fees. The key question now, of course, is: how do we at Stoic perform compared to these figures?

2021 was a year of stock market frenzy, as prices soared. The AEX, for example, surpassed 800 points in November: a record high. This means that virtually everyone who invested in stocks achieved substantial returns in 2021, whether you invest actively, passively, or ultra-passively (as we do at Stoic).

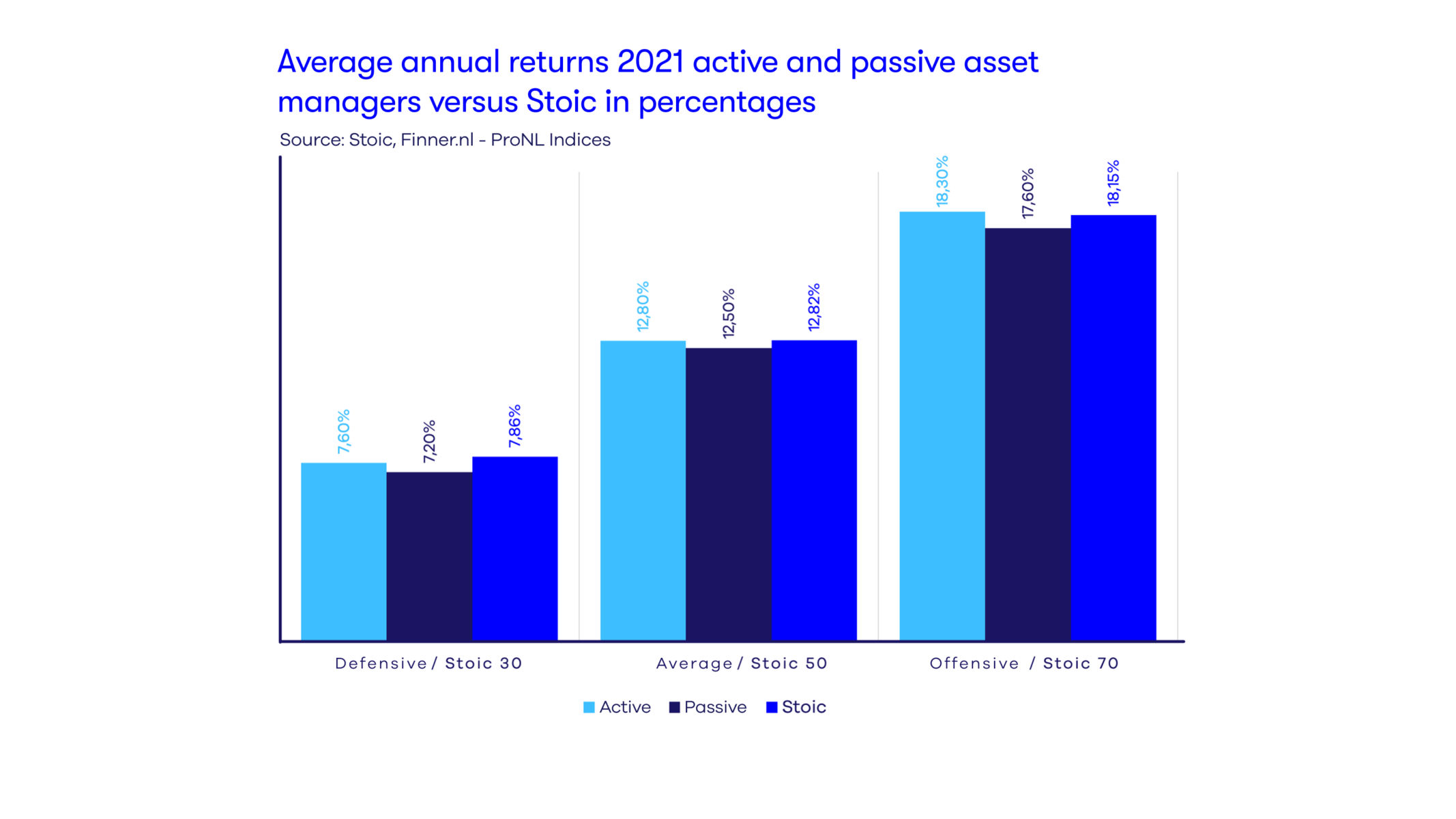

Active vs. passive vs. Stoic in 2021.

Let's first look at the comparison of average returns between active and passive asset managers and Stoic (see the bar chart below based on Finner's ProNL Indices). We see that active managers outperformed passive managers in 2021, but not necessarily Stoic. Stoic scored slightly better on the defensive and neutral profiles than the other active and passive managers. However, on the offensive profile, we scored 0.15% lower than active managers, but 0.55% better than the passive manager average.

So, kudos to active investors

Unfortunately, the reality is a bit more complex. The risk of an active investment strategy is (much) higher: after all, they try to achieve a (much) better return than the market return based on "predictions." In doing so, active managers essentially create the expectation that they will generally perform significantly better than passive managers who simply follow the stock market. On average, this is only marginally the case for 2021, despite the ever-rising prices. This is partly because very active trading goes hand in hand with high transaction costs, which naturally significantly reduce the potentially high returns. In short: it's as if an active manager in a hugely expensive sports car with a powerful V12 under the hood narrowly beats the boring, passive investor in a standard Toyota. You'd expect something different, wouldn't you?

Now, you might know a very active manager who actually achieved a much better return last year than the averages shown here. However, there are other active investors who significantly underperformed. After all, that's how the average return of the ProNL Indices is calculated. You've probably already guessed it: there's no one who can tell you which asset manager will be the best in the coming year...

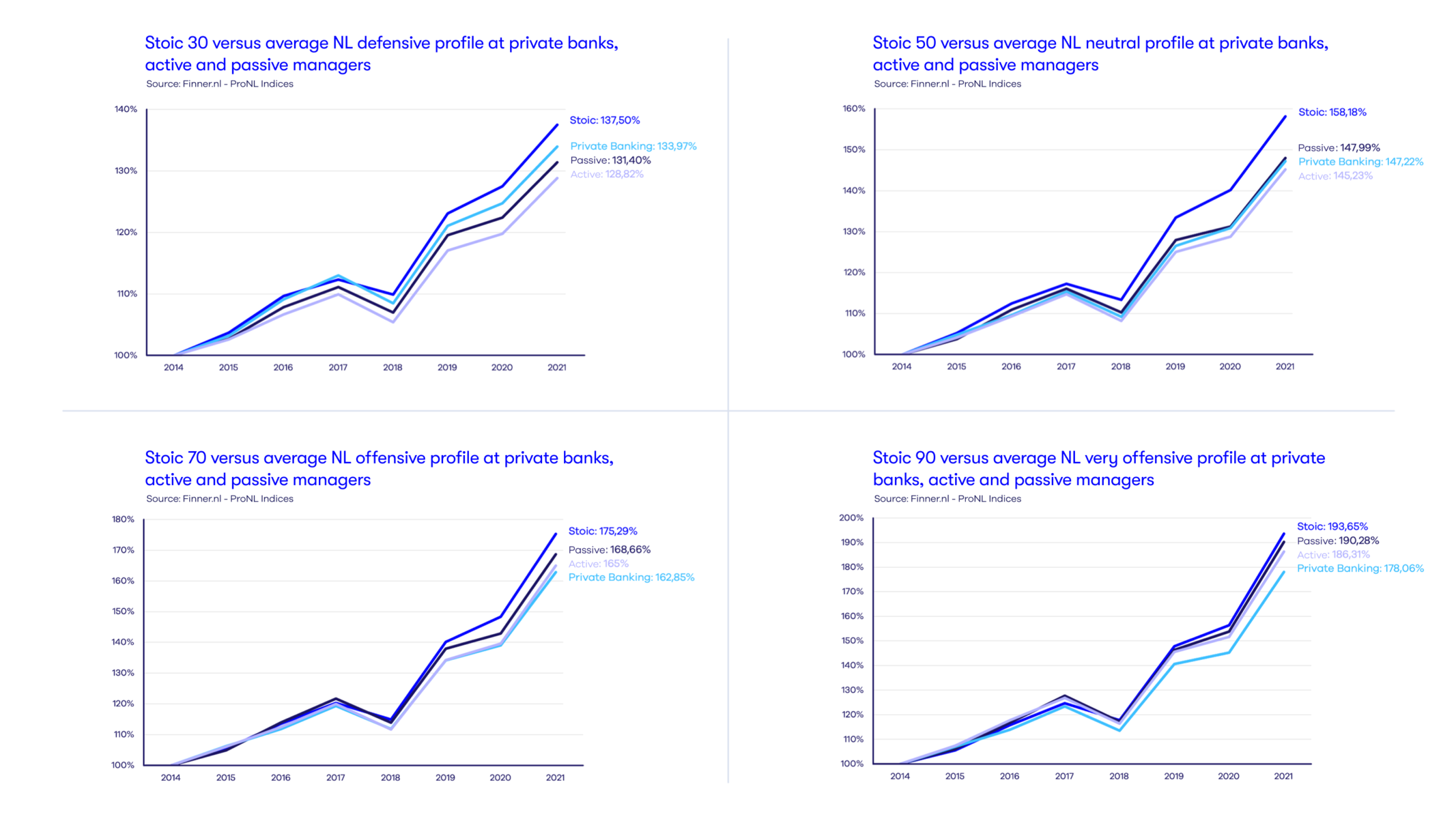

After all, if we zoom in on the risk taken by active investors, it means that no one can consistently predict the market better than anyone else, year after year. No one possesses a crystal ball that actually works. The result: an active manager might achieve incredibly good returns one year, but unfortunately, they'll always make bad bets in other years. It's nice that active investors are performing slightly better on average in 2021. But how many less successful years are there to offset that? It's therefore more useful to compare performance over a slightly longer period. We do this in the graphs below for the various profiles.

Conclusion: Stoic consistently outperforms the rest.

Across all profiles, Stoic outperforms the average return of the entire group of Dutch asset managers, regardless of whether they employ an active or passive investment strategy or operate as a private bank. And the reason for this is as logical as it is simple: at Stoic, we don't make any predictions or assumptions about the stock market. We diversify your money across the entire global economy and then simply wait and see. This simply proves to be the best value for your money.

How does that happen?

That's because absolutely no one has the gift of predicting stock prices. Active investors, by trading based on predictions, try to achieve higher returns than the return of the entire stock market. Sure, they might, with a bit of luck, achieve incredibly high returns one year, only to be completely off the mark the next. Tough luck. And that, on average, leads to lower returns over a longer period (in this case, since 2014).

Passive managers do the opposite: they "track" the market's returns. But in our view, most passive managers are nowhere near passive enough: they choose to invest long-term (and therefore passively) in a specific index, rather than in the global index as a whole. At Stoic, we consider this a "predictive" choice in itself. After all, they're betting that the chosen index will outperform another index or the global economy as a whole. And that, on average, also leads to lower returns.

Then there are the private banks: one employs an active strategy, the other a passive one. Yet, they have one thing in common: they often charge relatively high fees for their high-end services. And that weighs disproportionately on returns. Costs are simply the best predictor of a good return: the lower the costs, the more return remains. That's precisely why we at Stoic try to keep costs as low as possible, unlike what's customary at private banks.

In short: if you want the best bang for your buck, Stoic is the place to be. That's not just a disguised advertisement. The facts prove it.