Returns are unpredictable, but costs are a fact. High costs can even make a nice return go up in smoke. That is why we at Stoic have very low costs. In the blog and video below we explain why low costs are so crucial and how we at Stoic manage to have the lowest costs in the market.

In the perception of many people, asset managers all charge very low costs. The 1% to 2% that an average asset manager charges is hardly anything, right? Unfortunately, the reality is less rosy. You are forgetting the so-called compound interest effect; also known as the compound effect. This is such a strange effect that Einstein once called it the eighth wonder of the world. How does that work exactly?

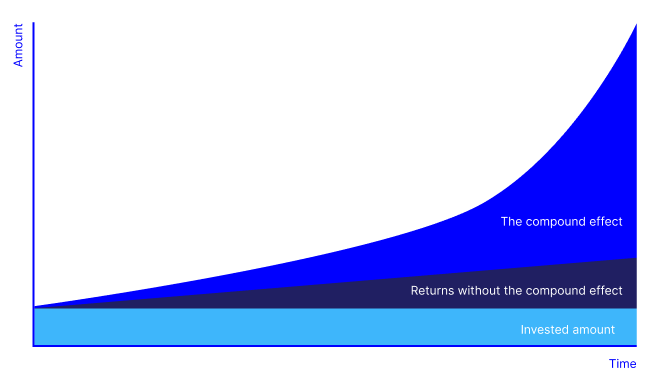

The compound effect, ergo: the compound interest effect, is special, but actually works very simply: by compound interest we mean that the interest is calculated on a growing sum of money every year. During a fairly long initial period, not much happens. But when a kind of invisible boundary is crossed, then strangely enough it suddenly starts to add up very quickly. The growth is said to be exponential and the associated graph (see below) resembles the proverbial hockey stick.

But how does that compound effect work with costs that are charged as a percentage of the assets? Well, just as the value of your assets grows exponentially over a long period, because you make a return on a growing sum of money every year, costs can eat up your assets in the opposite way. In that case, a nice return still goes up in smoke, while your asset manager is the one laughing.

To illustrate, a calculation example:Suppose you invest €1,000,000 in shares that generate a return of 5% each year. But you also pay your asset manager 2% in costs. After thirty years, your net assets (i.e. after the annual deduction of 2% costs and based on an annual return of 5%) have grown to an amount of €2,427,262. Sounds great, right?

But suppose you had paid only 0.7% in costs on the invested capital with another manager. Then the same €1,000,000 would have grown to €3,536,138 after thirty years. That is a difference of €1,108,786! Money that has disappeared straight into the pockets of your asset manager who charges 2% in costs. So you are missing out on a larger amount than you initially invested. This example makes it clear why low costs are so important for a good return. But from now on also for your peace of mind.

What costs do you pay at Stoic?

On our costs page you can see how our costs work. On this page you can even compare the costs that you may pay at your current asset manager with ours. According to the legislation (MiFID II), an asset manager must provide insight into all costs that an investor pays annually. This does not only concern the management fee, but also the fund costs, transaction costs, custody fee and the implicit transaction costs. You should be able to find these costs in your quarterly or annual report from your asset manager. Sometimes you have to search very carefully, especially if the costs are on the high side. That gives food for thought...

How do we achieve such low costs at Stoic?

Firstly, we use an ultra-passive investment strategy. We hardly trade at all, which means the associated transaction costs are low. And our extensive automation ensures greater efficiency, which also has a cost-reducing effect. Furthermore, we do not have an expensive office building on an Amsterdam canal, we do not organize fancy relationship events and we do not give you an expensive bottle of wine for Christmas. After all, you pay for that yourself, right?