The independent asset manager comparison site Finner.nl recently published its ProNL index figures for the first quarter of 2022 in this article. These figures reflect the average returns achieved by Dutch asset managers in the first quarter of this year, after deducting fees. The key question now, of course, is: how do we at Stoic perform compared to these figures?

Global stock markets fell sharply last quarter. For example, our own Dutch AEX index stood at 827 points on November 17, 2021 – its highest point ever. Just one quarter later, the AEX was down more than 100 points. Things can change.

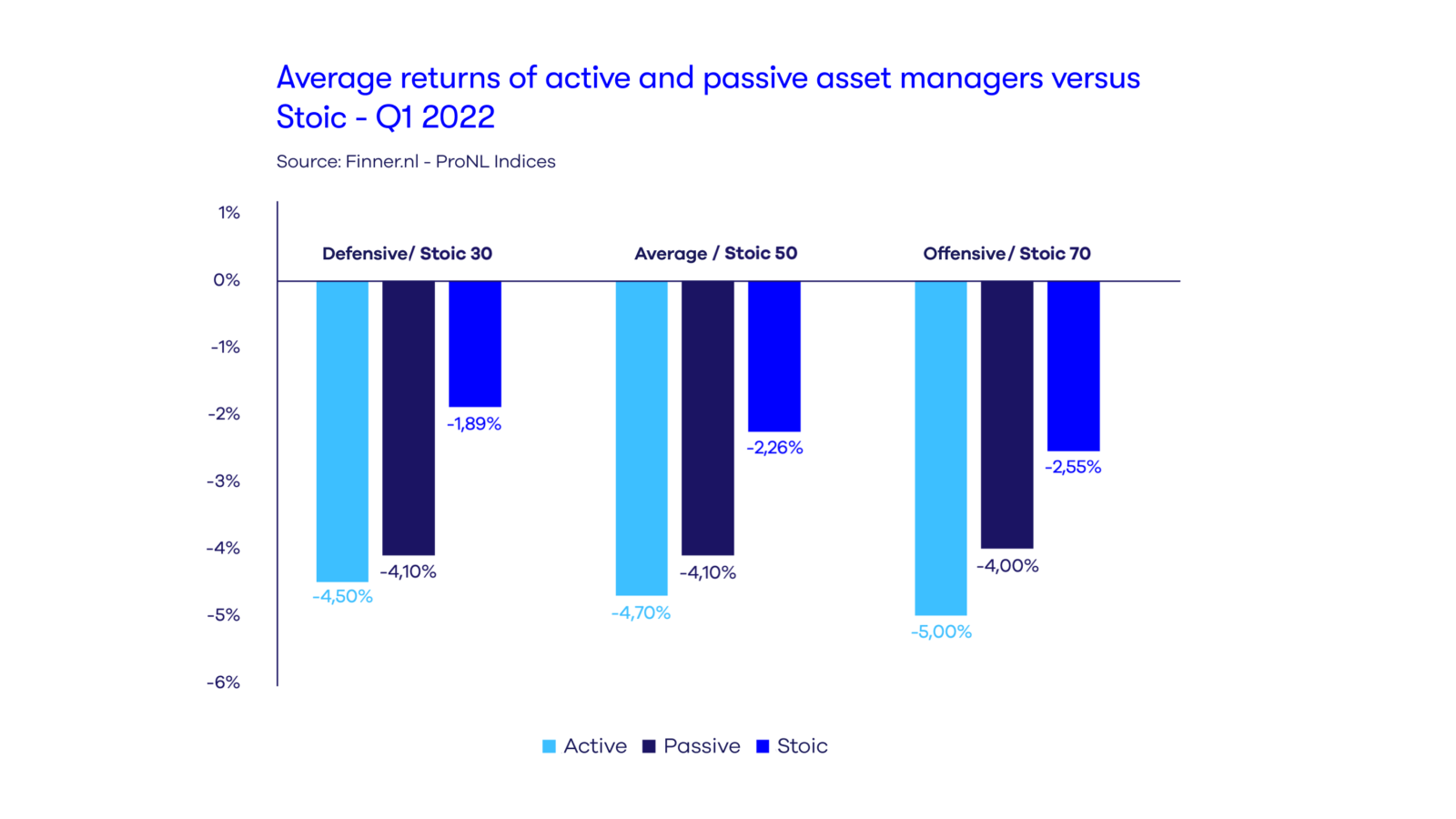

The logical consequence is that every asset manager in the Netherlands posted a negative return in this first quarter. But it's precisely during difficult times that you can discover which asset managers invest better than the rest. And guess what: Stoic also outperformed the average Dutch passive or active asset manager in the first quarter of this year.

As you can see in the chart above, Stoic has significantly lower losses than the rest in every profile. Why is that?

- That's because we always diversify the equity portion of our portfolios across all stocks worldwide. This ultimate diversification somewhat mitigates losses on the stock markets. Tech companies, for example, have faced sharp price declines. These are mitigated by the somewhat more stable prices of larger, traditional companies.

- That's because the bond portion of our portfolios consists solely of truly risk-averse bonds. This is often different with other managers. Many managers use relatively risky bonds, resulting in greater losses than necessary.

- That's because we charge the lowest costs in the market. This simply results in a higher return. And in the event of a loss, that loss is limited.

So active investing doesn't work.

It's also striking that the average active asset manager underperforms the average passive manager. This is odd: the goal of an active investment strategy is to beat the stock market. In bad times, like now, the active manager's promise should be that active trading can limit losses. But that promise isn't being kept. Passive investing simply turns out to work better than active investing. And our stoic approach to investing is, in fact, ultra-passive. We call our approach "Calm Capital Control," and with that, we significantly outperform the average active and passive manager in the Netherlands.