In the third quarter of 2023, independent asset management comparison site Finner.nl once again mapped the returns of the average Dutch asset manager. This was an interesting period, as interest rates on the capital market have risen. We see striking results when comparing Stoic with the average returns of Dutch asset managers.

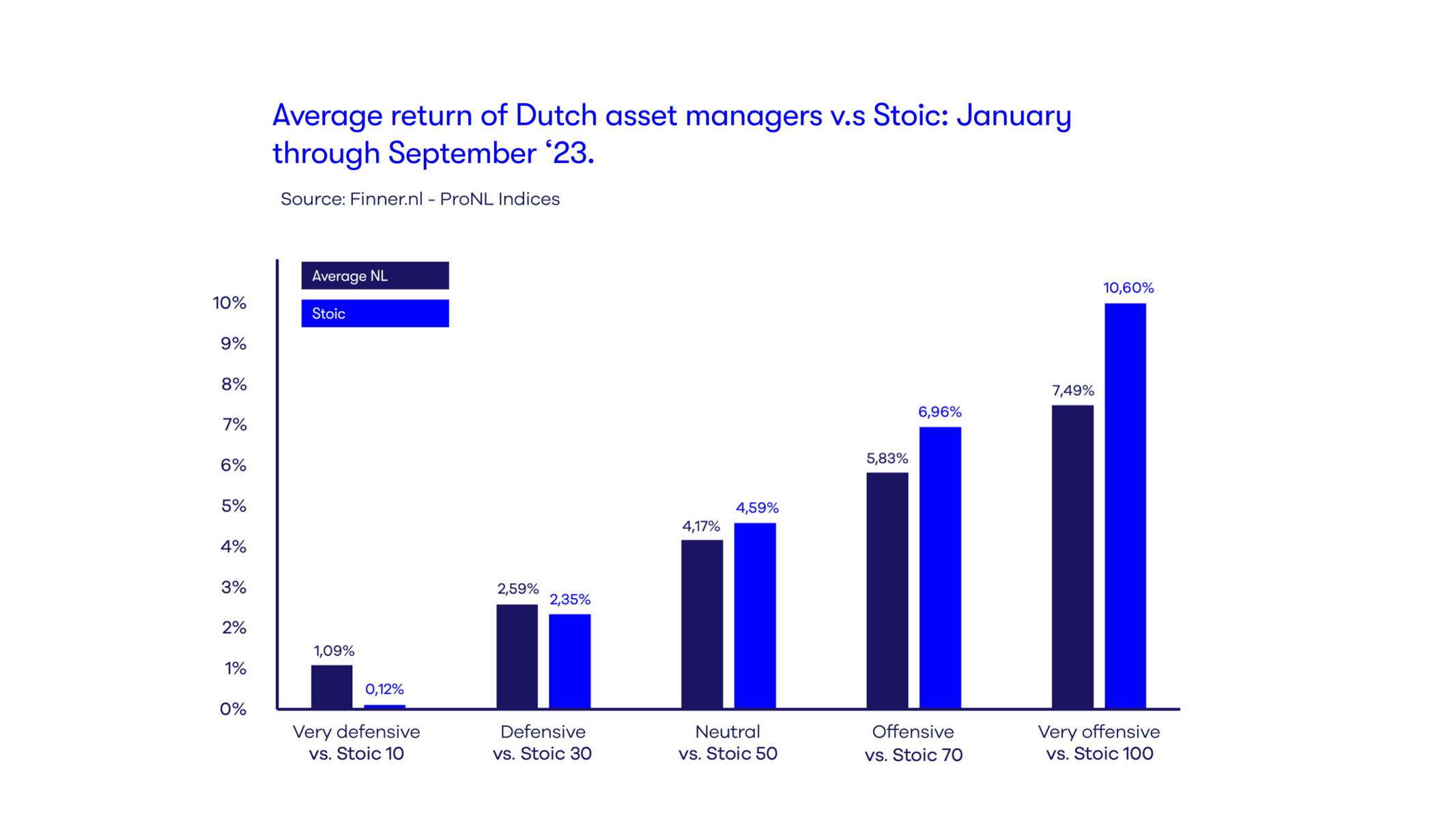

After the third quarter of 2023, it appears that Stoic is performing (much) better than the average Dutch asset manager in the neutral and offensive profiles. However, Stoic scores slightly worse in the two defensive profiles. This is shown in the chart below, which compares our returns with Finner's Pro NL Index:

Why lower returns on more defensive profiles?

Defensive profiles consist mainly of bonds. These are loans you provide and receive a predetermined interest rate. Therefore, there's hardly any risk, hence why these are defensive profiles. However, price fluctuations also play a role in bonds. Because interest rates have risen recently, the price of your bonds has fallen. For example, suppose you own a bond that started in 2015 with an interest rate of 2%. Since then, the interest rate in the capital market has risen to 3.2%. This means that people can now buy bonds that pay more interest. This makes your bond less valuable for trading. And this is factored into the return we achieve with our defensive profiles. After all, if you were to sell your bond now, at this moment, it would yield less.

This, of course, applies to all asset managers. So why do we still score lower? It's because the average Dutch asset manager actually takes risks, which you wouldn't expect with defensive profiles. In financial markets, return is the price of risk: so the more risk, the higher the return (if all goes well, of course). That's precisely what you're seeing now: the average asset manager takes more risk with bonds than we do, in order to still achieve a "decent" return with "boring" bonds. At Stoic, however, we believe a defensive profile should truly be defensive. Therefore, the bond component always consists entirely of government bonds from reliable countries, such as Germany or the Netherlands. But that does yield slightly less at the moment than, for example, a somewhat riskier corporate bond.

More evidence that the rest of the Dutch asset management community is taking more risks in defensive profiles where you wouldn't normally expect it can be found in the recent past, when we look at the returns of defensive profiles in 2022 (a very tough stock market year). Stoic achieved a negative return of -8.71% in the very defensive Stoic 10 profile. However, the average manager achieved an even worse return of -12.83%: a difference of 4.12% in Stoic's favor. For the defensive Stoic 30 profile, that difference was 3.3% in Stoic's favor.

As supreme investor Warren Buffett always says: "When the tide goes out, you find out who's swimming naked." The risks the average Dutch asset manager takes to achieve a 'decent' return with defensive profiles were mercilessly exposed. These same risks are now, in the current, somewhat more buoyant market climate, ensuring a slight improvement over Stoic. Just not by a huge margin: while the difference last year was 4.12% and 3.3% in Stoic's favor, respectively, it's now 0.97% for the very defensive profile and 0.24% against Stoic for the defensive/Stoic 30 profile. You understand: this way, they're far from making up for the significant differences of 2022.

At Stoic, we believe that defensive profiles should be truly risk-averse, even if that leads to slightly lower returns. After all, the point is that your money is still there when you need it. Apparently, others disagree. If you want to know more about the risks that can be hidden in so-called risk-averse bonds, you should read this blog article.

Significant differences in the offensive profiles

It becomes even more interesting when we look at the offensive profiles. While the differences in the defensive profiles are very small, they are much larger in the offensive profiles. Stoic scores 3.11% better on the very offensive profile than the rest of the Netherlands. Quite strange: the average Dutch asset manager takes slightly more risk than Stoic. The expectation is that this should lead to better performance in the offensive profiles. But that's not the case. Our ultra-passive, stoic investment philosophy, in which we buy all the stocks in the world and then do nothing but wait patiently, simply works best. Your money grows smoothly with the global economy. And you don't incur unnecessary transaction costs by constantly entering and exiting. This leaves you with a higher return.

The fact that Stoic is currently outperforming the average Dutch asset manager in the aggressive profiles is no coincidence. In 2021, we outperformed the average Dutch asset manager by 3.5% with the very aggressive profile. In 2022, when the stock market collapsed, Stoic lost 0.5% less than the rest of the Dutch asset management industry. And yet, we take significantly less risk than our competitors across all profiles. In short: Stoic's Calm Capital Control is not only good for your peace of mind, but also for your money.