Once again, the latest ProNL index figures from Finner.nl (a comparison website for asset management) show that, in these challenging stock market times, Stoic is (much) better at limiting losses than the average Dutch asset manager, after deducting fees. Read more in this blog post.

It's no surprise that every asset manager is currently posting poor returns: after all, global stock markets are falling. War in Ukraine; inflation signaling an overheated economy and possibly an impending recession; skyrocketing gas prices; this is a "Perfect Storm" for loss of confidence in the economy, and therefore also loss of confidence in stocks.

Stay calm is our motto. Because at Stoic, we don't get distracted by the latest trends. Stock prices can fluctuate unpredictably in the short term, but the global economy always grows ultimately. History shows us that recovery usually doesn't last longer than 10 years. So if you have ten years, there's essentially nothing to worry about. At least, if you've diversified your assets across virtually all stocks worldwide, as we do at Stoic.

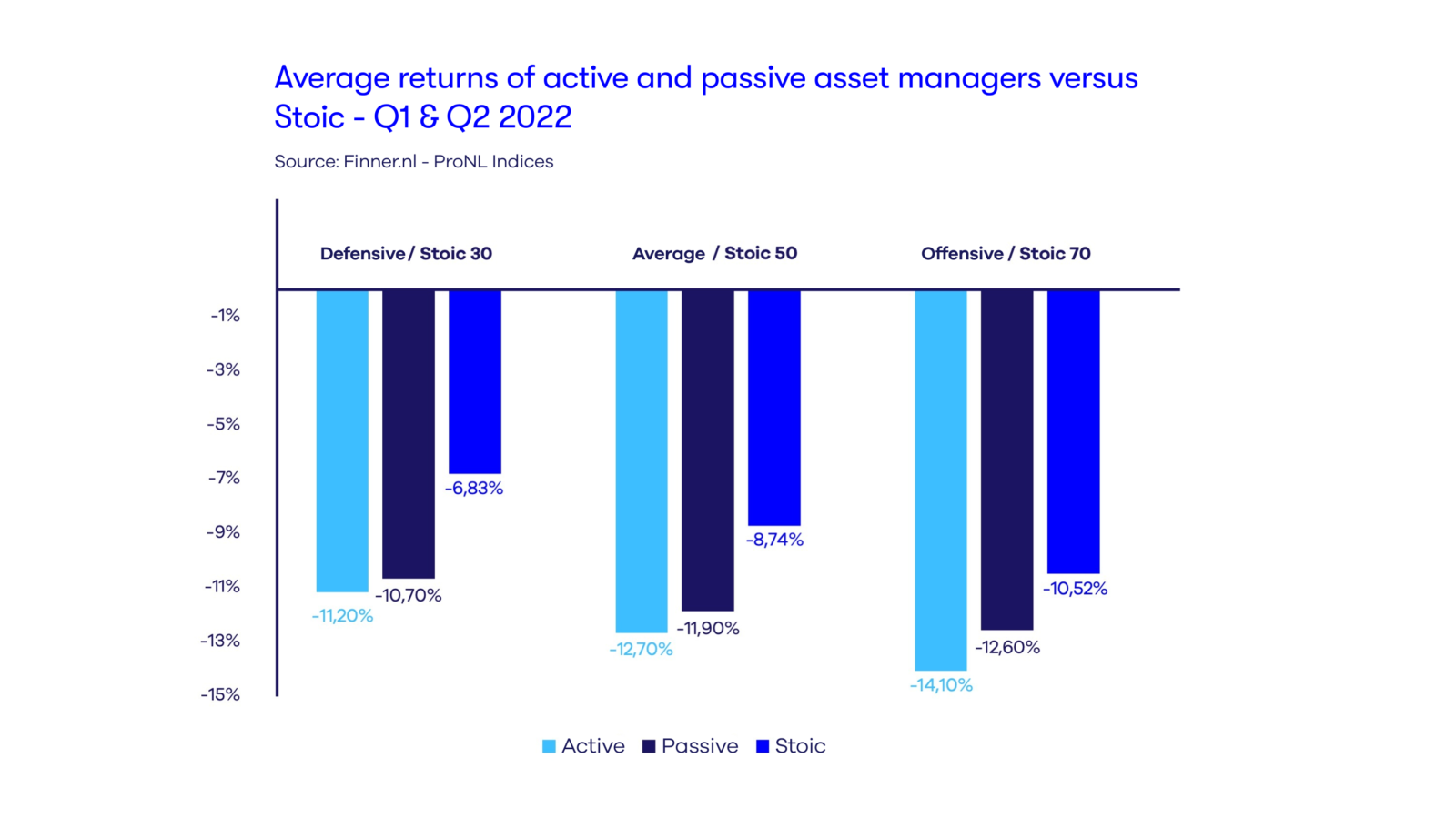

This ultra-passive, stoic investment philosophy works. Because in the graph below you can see that Stoic is obviously making a loss, but that we are much better able to keep those losses within limits than the rest of the Dutch asset management sector.

It's certainly striking that the average active asset manager underperforms the average passive manager. This is odd, because the goal of an active investment strategy should be to beat the market. In bad times, one should be able to limit losses by finding precisely those stocks that perform relatively well. But because no one possesses perfect predictive powers, that promise is never fulfilled. Passive investing simply turns out to be better than active investing.

It's also striking that the difference between passive managers and Stoic is significant. This is because our stoic investing approach is ultra-passive rather than "regular" passive. While a regular passive investor often makes an "active," predictive choice, we absolutely never, ever, do that. A passive manager might, for example, choose to invest in the AEX index for the long term, without intermittent entry and exit, but not in other indices. They would then have more faith in the AEX than in another index, and that is essentially an "active" choice. At Stoic, we always invest your assets across the entire global economy: we don't make any "active" choices, simply because we are 100% certain that no one possesses predictive powers. No one knows which index will outperform the others. So we invest in everything, worldwide.

We call our asset management approach "Calm Capital Control," and with that, we significantly outperform the average active and passive manager in the Netherlands. Time and again, quarter after quarter, the figures prove this. It's getting a bit boring, but unfortunately, there's nothing we can do about that. If only everyone would invest ultra-passively.