Everyone tries to predict the stock market, but at Stoic, we focus on the facts. And they tell us that it's not analyst reports, but the timeframe that determines the composition of your investment portfolio: what's your investment horizon? How long can you afford to lose your money? In this blog post, we explain why a clear, hard deadline is crucial to the Stoic investment strategy. Watch the video and/or read the blog post below.

At Stoic, we're constantly amazed by the deluge of technical and fundamental analyses, bar charts, and candlestick graphs online—all designed to predict the stock market. But at Stoic, we know that absolutely no one is capable of accurately predicting stock prices year after year. No one saw the coronavirus crisis coming, nor the frenzy surrounding Gamestop stock.

At Stoic, we base our approach on the undeniably proven fact that stock prices bounce around every day, but that the global economy ultimately grows in the long run. Invest long-term and super-passively in all stocks worldwide, and you'll automatically see a good return. But how long is long-term?

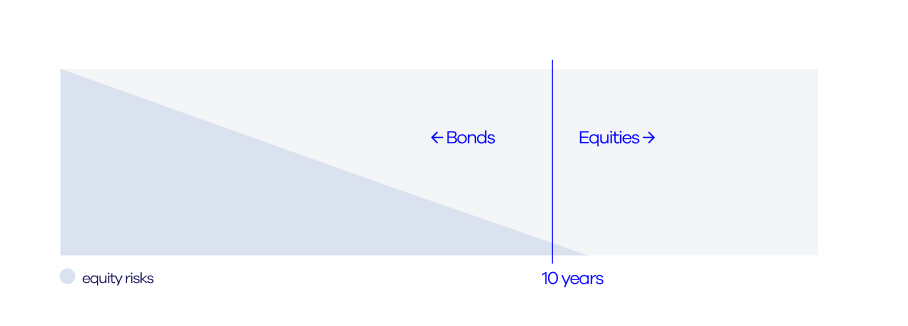

Maturity longer than 10 years: equities

According to our stoic investment philosophy, anything you can afford to lose for more than 10 years should be invested entirely in equities. Historical data tells us that it can take about 10 years for a crash to recover. Only the Great Depression that followed the stock market crash of October 4, 1929, lasted longer. But as a rule, stock markets need a much shorter recovery time. For example, the Black Monday Crash of 1987 (the first crash after World War II) took "only" 15 months to recover. The major credit crisis of 2008 recovered within four years, and the stock market even recovered from the decline caused by the coronavirus crisis that erupted in 2020 within one year.

Of course, we can't predict which companies will go under in the financial turmoil and which will emerge stronger. That's dangerous: just think of the dotcom crash in 2001. If you had invested all your money specifically in the American NASDAQ index (and not in all stocks worldwide), you would have simply lost it. Dozens of dotcom companies listed on the NASDAQ went bankrupt at that time. That's why at Stoic we always diversify your money across all stocks worldwide.

So, the facts tell us that after about 10 years, there's a good chance that the stock market—no matter what happens in the meantime—will have reached at least the same price level as when you invested. But in the meantime, you'll have benefited handsomely from all the dividend payments. This means you'll definitely see a profit.

And, importantly, you've been fully protected against inflation throughout this time. Suppose the unlikely event does happen and the global economy stops growing. Your stocks will then be worth less in the future than they are now. But at the same time, everything in the world has become cheaper. Your purchasing power has therefore remained the same. Read more about inflation and purchasing power in this blog.

Maturity less than 10 years: bonds

Money you need within 10 years should be invested in very safe government bonds. During this period, there's a very good chance that a potential stock market crash won't have recovered. Safe bonds ensure your money can never lose value. They are loans you make, for which you receive a predetermined interest rate. You can even buy bonds with maturities that correspond to when you need your money again. If you want to use your money within 3 years, at Stoic we invest it in very short-term German and/or Dutch government bonds with an average duration of six months. Or if you want to use your money between 3 and 10 years, we invest it in government bonds with an average duration of 4.5 years. We always choose government bonds with the highest credit rating: for example, those of the German and/or Dutch government. There are also risky bonds that should be avoided. Read this blog post about how bonds work.

The 10-year term limit is therefore the most important criterion for us when we structure your investment portfolio. It's so simple, anyone could do it themselves. But unfortunately, what's not so easy is curbing your emotions. All sorts of things happen in the meantime with the money you invest in stocks for at least 10 years. For example, during the coronavirus crisis in 2020, investors saw the value of their investments plummet by as much as 30%. Terrifying, of course. Someone who suddenly sees their invested capital shrink from €1 million to €700,000 wants only one thing: to stop the loss by exiting. But if you do, you know one thing for sure: that you'll have to accept a crushing loss.

That's why at Stoic, we help you keep your emotions at bay at such times. Of course, you can also simply exit immediately, but not before we've first explained that simply staying put is far more sensible, simply because the global economy always grows in the long run. In short: at Stoic, we don't get distracted by the daily grind. We focus on that one point on the horizon: the moment you want to use your money again. That's not only good for your money, but also for your peace of mind. That's why we call our asset management approach Calm Capital Control.