Now that financial markets are plummeting due to the war in Ukraine, it's becoming clear that many asset managers are taking on too much risk. Some are currently losing far more than one would expect based on the risk profile of their investment portfolios. The ace investor Warren Buffett once put it so eloquently: "When the tide goes out, you discover who's been swimming naked." Stoic explains why and what you can do about it.

Let's start with the basics: an investment portfolio generally consists of "risky" stocks and "risk-averse" investments like bonds. Stocks are considered "risky" because you don't know what the prices will do. Because you're taking a lot of risk, you're rewarded with a high return. But the chance of a significant loss is also high. Bonds, on the other hand, are considered "risk-averse": because they are loans that pay a fixed interest rate, you know in advance how much return you'll receive in the form of interest. Due to this limited risk, your return on bonds is much lower. Furthermore, bonds act as a counterbalance to stocks: when stock markets fall, investors flock to bonds.

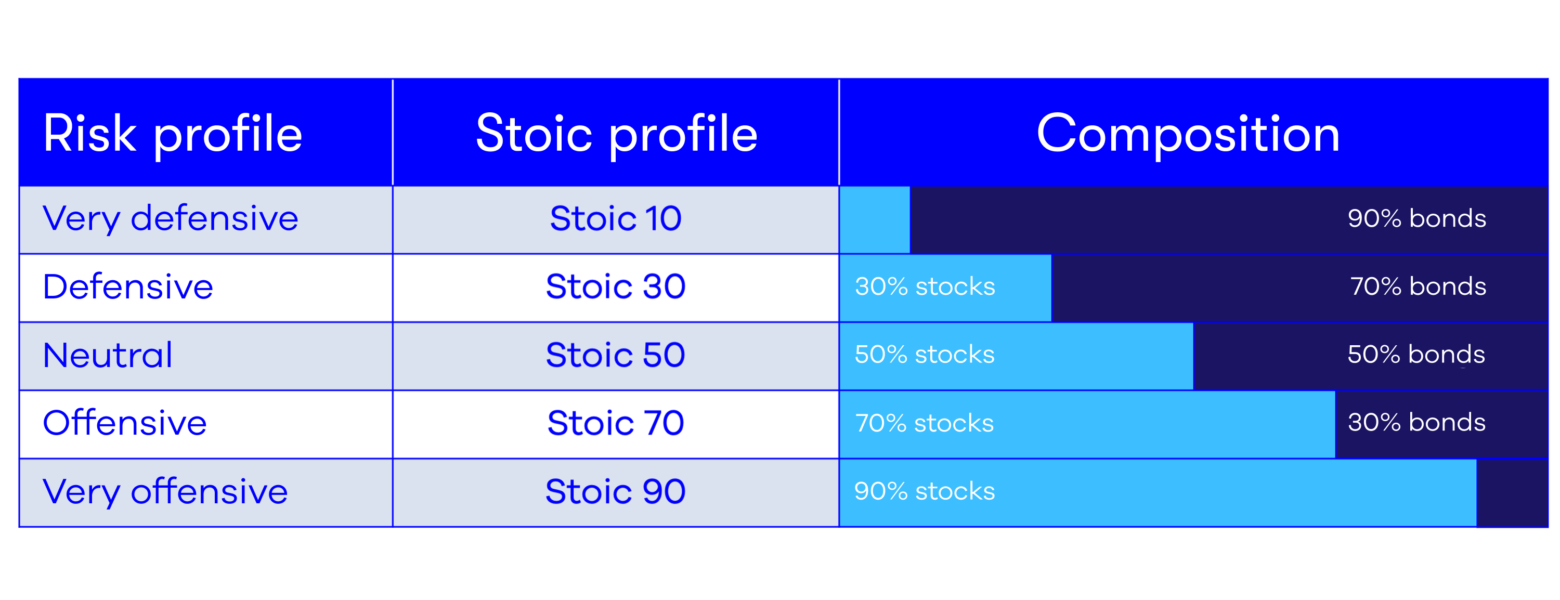

Below you can see the classic classification of the different risk profiles and the names we have given them at Stoic.

What exactly is going on with some asset managers?

Some are currently losing much more than you might expect based on the risk profile of their investment portfolios. For example, the Rabobank "Neutral" profile posted a negative return of -5.81% at the end of February 2022. This is while our comparable neutral Stoic 50 profile only posted a loss of -3.28%. In fact, the negative return of the "neutral" profile at Rabobank even approaches that of our very aggressive Stoic 90 profile, which currently posted a loss of -5.94%. In other words, at Rabobank, the "neutral" profile actually turns out to be a "very aggressive" profile...

Or consider the neutral profile for Evi van Lanschot. At the end of February, it was at -7.04%! Our Stoic 60 profile (a slightly more aggressive profile than the aforementioned Stoic 50, because it holds 10% more shares) scored "only" -3.82% at the same time. That's quite a difference. Looking further back in time, we see that this isn't a coincidence. The neutral Evi van Lanschot profile scored -6% due to the crash in 2018. For the Stoic 50 and 60, that was limited to -3.32% and -3.87%, respectively.

How is that possible?

The neutral profile at both Rabobank and Evi van Lanschot should also consist of approximately 50% bonds. So how is it that their neutral profiles are declining so sharply, as if they were highly aggressive profiles? This is caused by factors such as the type of bond they've invested in. In this blog post, we previously wrote that not all bonds are risk-averse. For example, there are bonds issued by companies or countries with low credit ratings: since return is the price of risk, you get a higher return with these bonds, simply because you're taking more risk.

Many asset managers use these types of high-risk bonds to market an investment profile as "neutral," for example, while still achieving relatively high returns. According to the requirements, they invest approximately 50% in bonds. However, to achieve a better return than the competition or to offset the high fees charged, they use relatively high-risk bonds with a higher yield. Thus, the return on an investment profile labeled "neutral" still appears quite substantial. However, when financial markets decline, these types of companies are exposed. The negative returns are then much lower than you would expect based on the risk profile. This is what Buffett means when he says, "When the tide goes out, you see who's swimming naked."

What you can do.

At Stoic, we only use truly risk-averse bonds in our portfolios. Our return figures, which you can find here, can therefore be used to compare them with the returns your portfolio achieves with another manager. If this difference is roughly more than 2% for this year, then your bond portion is probably not entirely risk-averse. It's up to you to decide what to do next.