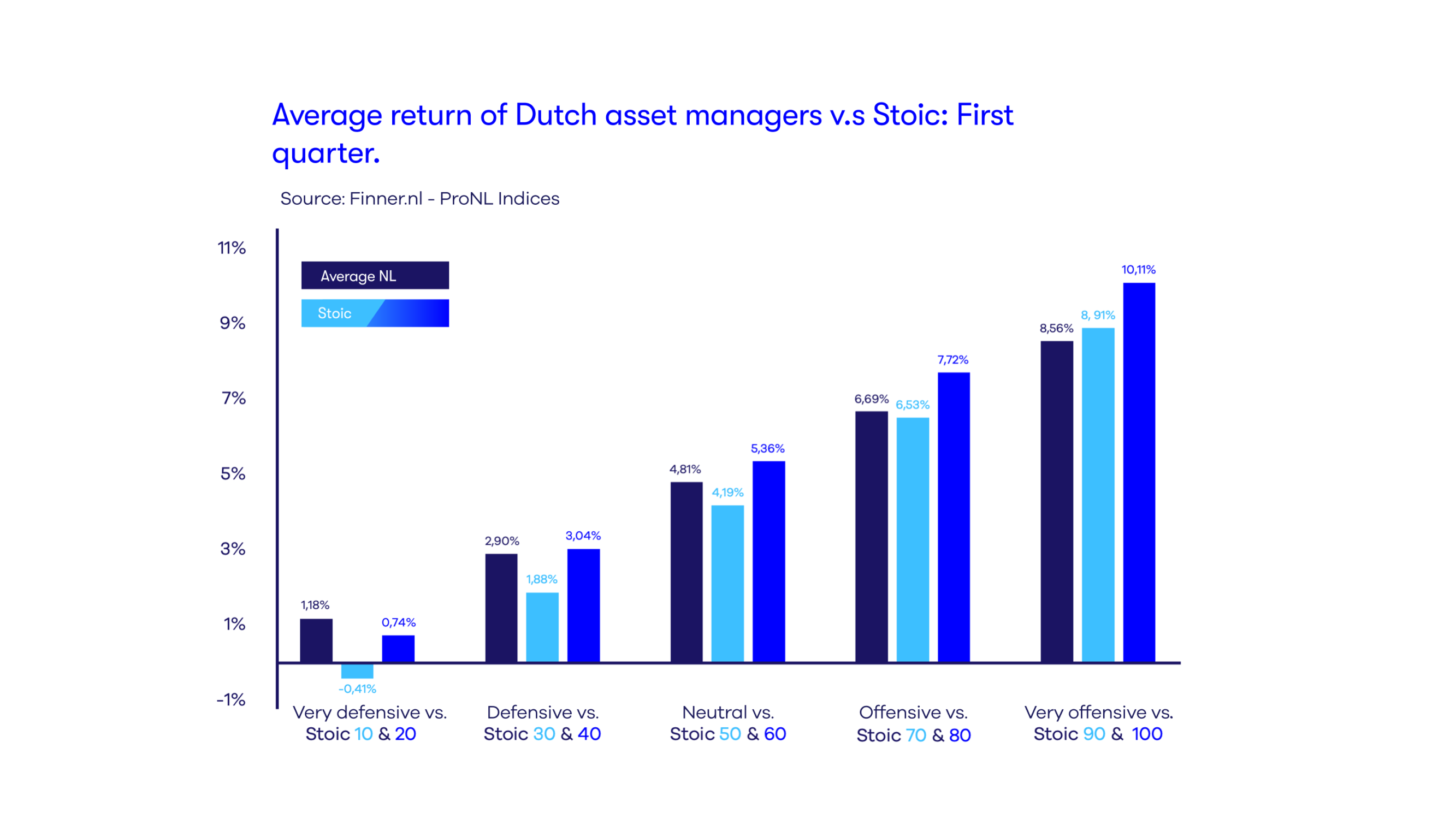

As usual, we're comparing the returns of our own profiles for the first quarter of 2024 with the ProNL Index for that same quarter. The ProNL Index is an index from asset management comparison site Finner, which represents the average returns of asset managers in the Netherlands across five different risk profiles. Once again, we're seeing striking differences, which we'd like to explain for you, quite stoically, using the hard facts.

Stoic scores lower in the more defensive profiles. But there's a reason for that:

"Defensive" in the world of asset management means "risk-averse," and therefore: bonds. Stock prices can be quite risky, but a bond is essentially a loan on which you receive a predetermined interest rate. So, no risk. After all, you know in advance what you'll earn. You choose bonds to be sure your money will still be there when you need it, not so much to achieve a good return, because stocks are better suited for that.

Unfortunately, many asset managers try to entice clients by slightly boosting the returns of their defensive profiles. "Look, even with our risk-averse profile, we're achieving a good return!" This boosting is, of course, achieved by "secretly" taking more risk than you'd expect with bonds. For example, they opt for riskier "corporate bonds." These are bonds with an equity component.

At Stoic, we believe this is incorrect. According to our rational, stoic investment philosophy, an investment in a risk-averse investment product should actually be risk-averse. That's why we only invest in German and Dutch government bonds. Boring. But they do ensure your money is still there when you need it.

Well, riskier bonds perform well when the stock market is doing well. However, due to the higher costs of the asset managers who use these products, the difference is very small. But when the stock market performs less well, such as in 2022 (a "tough year"), the high costs combined with the "risk" of the equity component mean that these portfolios perform much worse than Stoic's purely defensive portfolios with only Dutch and German government bonds.

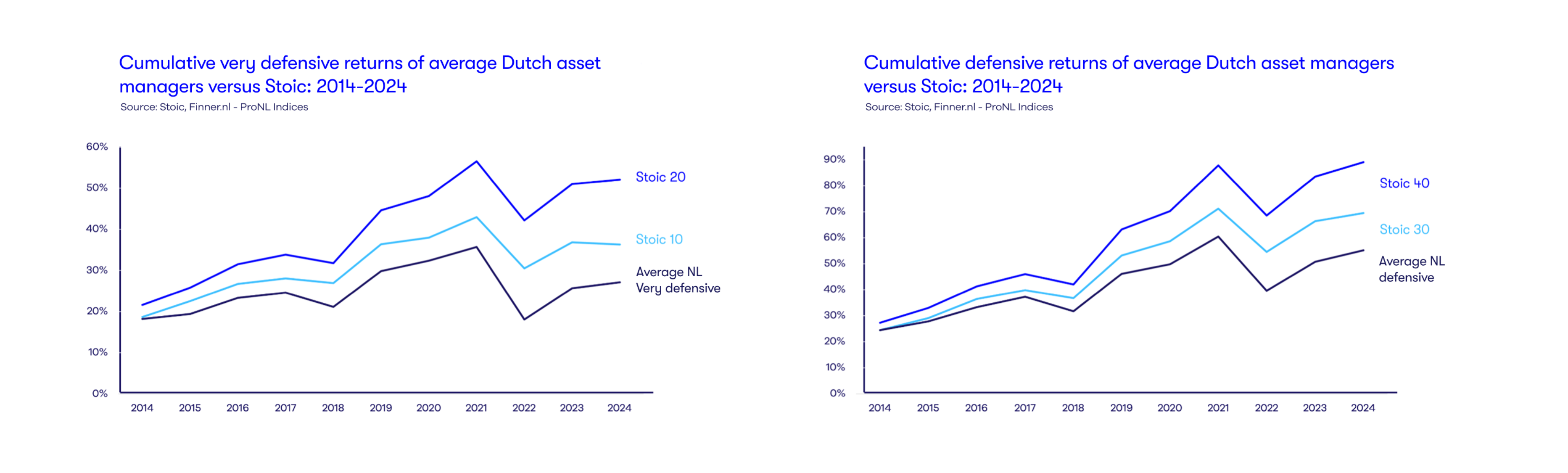

As stock market guru Warren Buffett famously said, "When the tide goes out, you find out who is swimming naked." The chart below shows that over a longer period—including the lean years of 2018 and 2022—Stoic's defensive profiles ultimately outperform the average Dutch asset manager. This is because Stoic significantly outperforms us during lean periods, while the average Dutch asset manager outperforms us during good periods.

In summary:

At Stoic, we believe a defensive profile should truly be defensive. Therefore, our bond portfolio always consists entirely of German or Dutch government bonds. However, these currently offer slightly lower returns than, for example, a riskier corporate bond. However, if the economy hits a rough patch, you'll be in luck with Stoic. And that, in our opinion, is precisely the goal of bonds: it's not so much about 'return on the money,' but about 'return of the money,' even in economic downturns. Looking for good returns? Equities are much better suited for that.

Differences between neutral and aggressive profiles

The fact that the average Dutch asset manager takes more risks with bonds also affects the neutral and aggressive profiles. Due to the risk many parties take with their bond portfolio, the comparison of the Stoic 50 profile (which consists of 50% bonds) with the neutral profile of the Pro NL Index is no longer accurate. It would be more fair to compare this "neutral" profile with Stoic 60. And Stoic 60 does outperform the neutral profile of the average Dutch asset manager.

However, if we look at a longer period, we also see that Stoic outperforms these neutral and aggressive profiles:

If you're purely concerned with returns:

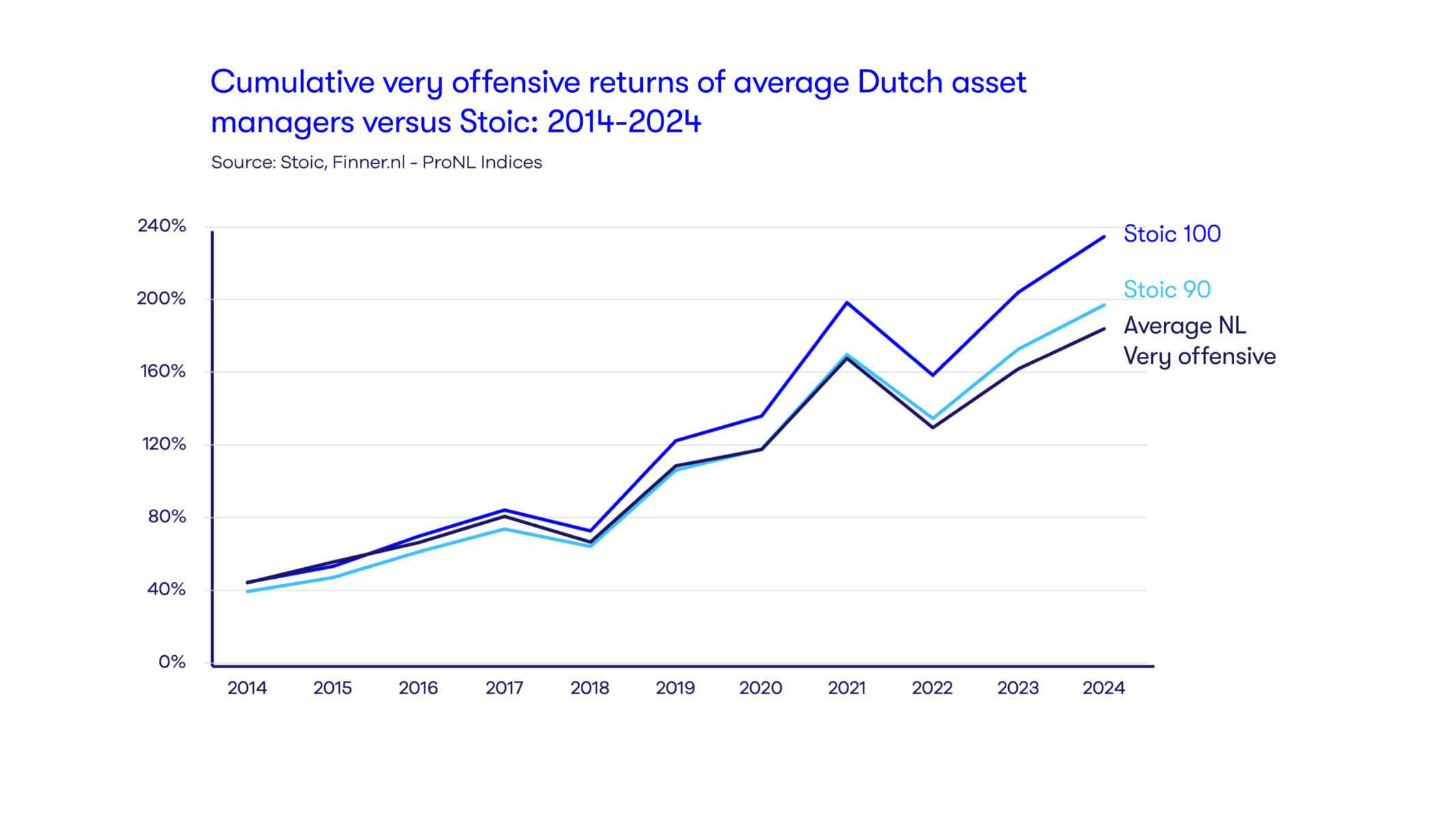

Then it's best to consider the Stoic 100 versus the "very aggressive" profile of the ProNL Index. Stoic 100 consists entirely of equities, ultimately and ultra-passively diversified across the entire global economy. The very aggressive ProNL profile also consists entirely of equities. That's a fair comparison. We've summarized these in the chart below: it's immediately clear that our stoic investment philosophy, in which we buy all the stocks in the world and then do nothing but wait patiently, works. Your money grows steadily with the global economy. And you don't incur unnecessary transaction costs by constantly entering and exiting. This leaves you with a higher return.