As usual, we also compare the returns of our own “profiles” with the ProNL Index for the first quarter of 2025 for that same first quarter. The ProNL Index is an index figure from asset management comparator Finner, which shows the average return of asset managers in the Netherlands in five different risk profiles. Once again, we see differences that we would like to explain to you very stoically, using the hard facts.

In the first quarter, investors worldwide became nervous due to the uncertainty about import duties and trade restrictions under the new US administration. Naturally, the shares traded on the US stock exchanges suffered the most. The logical consequence: negative returns for everyone in all types of risk profiles.

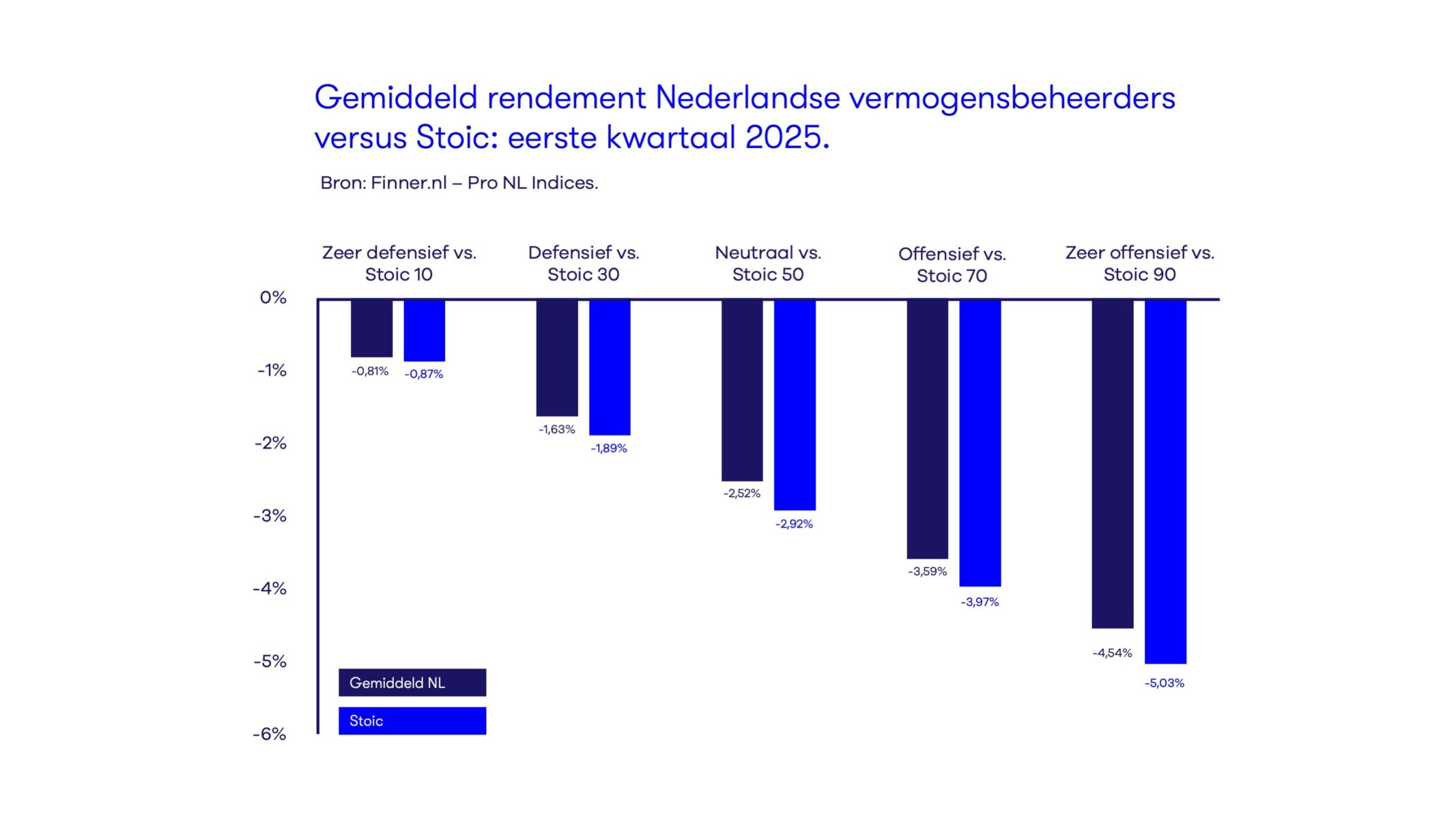

Above you see the graph in which we compare our realized returns from January 1, 2025 to March 31, 2025 with the ProNL index profiles. For the first time since we started comparing with the ProNL index, Stoic scores slightly worse on all profiles than the average Dutch asset manager. It is only a matter of tenths of a percent, but still: how is that possible? And is that bad?

First, an explanation of the profile names used: Stoic 30, Stoic 50, etc.

Stoic does not use risk profiles like other asset managers. We base the composition of your portfolio on your terms.

Stoic Medium: we invest all the money you can spare between 3 and 10 years in longer-term risk-averse government bonds. With this term, there is a real chance that a possible crash or recession on the stock market has not yet recovered.

Stoic Lang: we invest all the money you can spare for more than 10 years in all shares worldwide. The risk you take by investing in shares is very small with such a long term. Simply because a possible interim recession or crash has enough time to recover.

In order to be able to make the comparison with the standard risk profiles, we have created profiles whose profile names reflect the percentage of shares (Stoic Long) in the portfolio. For example, Stoic 10 consists of only 10% shares (Stoic Long) and 90% risk-averse government bonds (Stoic Medium). This can be compared to a standard ‘very defensive’ risk profile. For example, Stoic 50 consists of 50% shares (Stoic Long) and 50% longer-term government bonds (Stoic Medium). This is comparable to a standard ‘neutral’ profile. We often also use Stoic 60 for the comparison with the neutral risk profile, because many asset managers take hidden risks with the 50% bond portion in order to boost the returns of their ‘neutral’ profile. In the next paragraph we explain exactly how this works.

The explanation for the small difference in the more defensive profiles.Risks are avoided in these profiles by investing in bonds. However, many asset managers artificially increase the return of their ‘very defensive’ and ‘defensive’ profiles. They do invest in bonds in order to be able to use the predicate ‘defensive’ or ‘neutral’, but then in the riskier variants, such as corporate bonds. As a result, their returns are now slightly less bad.

The problem is that this actually means taking more risk than the ‘very defensive’, ‘defensive’ and ‘neutral’ profiles should represent. This becomes problematic if things really go wrong on the financial markets. During the stock market crash of 2008, many companies that had issued bonds were suddenly unable to meet their obligations. People who thought they were super safe with their portfolio full of bonds in those companies suddenly saw their bonds fall by 30%: as if they were seeing water burning… If they had actually invested in risk-averse bonds from, for example, the Dutch and/or German government, then nothing would have happened. If you want to know more about how bonds work exactly, read this extensive blog article: the role and risks of bonds in your investment portfolio.

The explanation for the difference in the more offensive profiles.

The more offensive profiles consist mainly of shares. As you know, at Stoic we always invest in a reflection of the entire global economy when it comes to shares. We do this because we are convinced that no one can predict which shares or which regions will perform best in the future. No one has a crystal ball that works. At Stoic we ignore the madness of the day and invest ‘without vision’ in the entire global economy. Because no matter what happens, in the long term the global economy always grows. That is a fact.

That sounds crazy: does America really determine 63% of the world economy? That can't be true? This does indeed seem to be at odds with other facts that tell us that the share of the American domestic economy in the total world economy is only 26%. This difference is caused by the fact that not all companies listed in America are actually American companies. Many companies from other countries choose to be traded on an American stock exchange, simply because this gives them the easiest access to big money. But they are located elsewhere and do business elsewhere. In addition, many American companies that are listed on the American stock exchanges operate worldwide. Apple, for example, realizes much more turnover outside the American borders than within them. All this leads to the fact that 'American shares' really do represent 63% of the world economy, if you look at the distribution of all shares worldwide.

Many other asset managers are guided by emotions and have decided to give American shares a smaller share in their equity portfolio. “Otherwise we will become far too dependent on America”, is the gut feeling. That gut feeling is currently working out slightly better for these asset managers than for Stoic. But, as mentioned, this is the first time in 15 years – a fluke. At Stoic, we do not believe in flukes. Because for this one time that you happen to be right, there are countless other times that you are wrong.

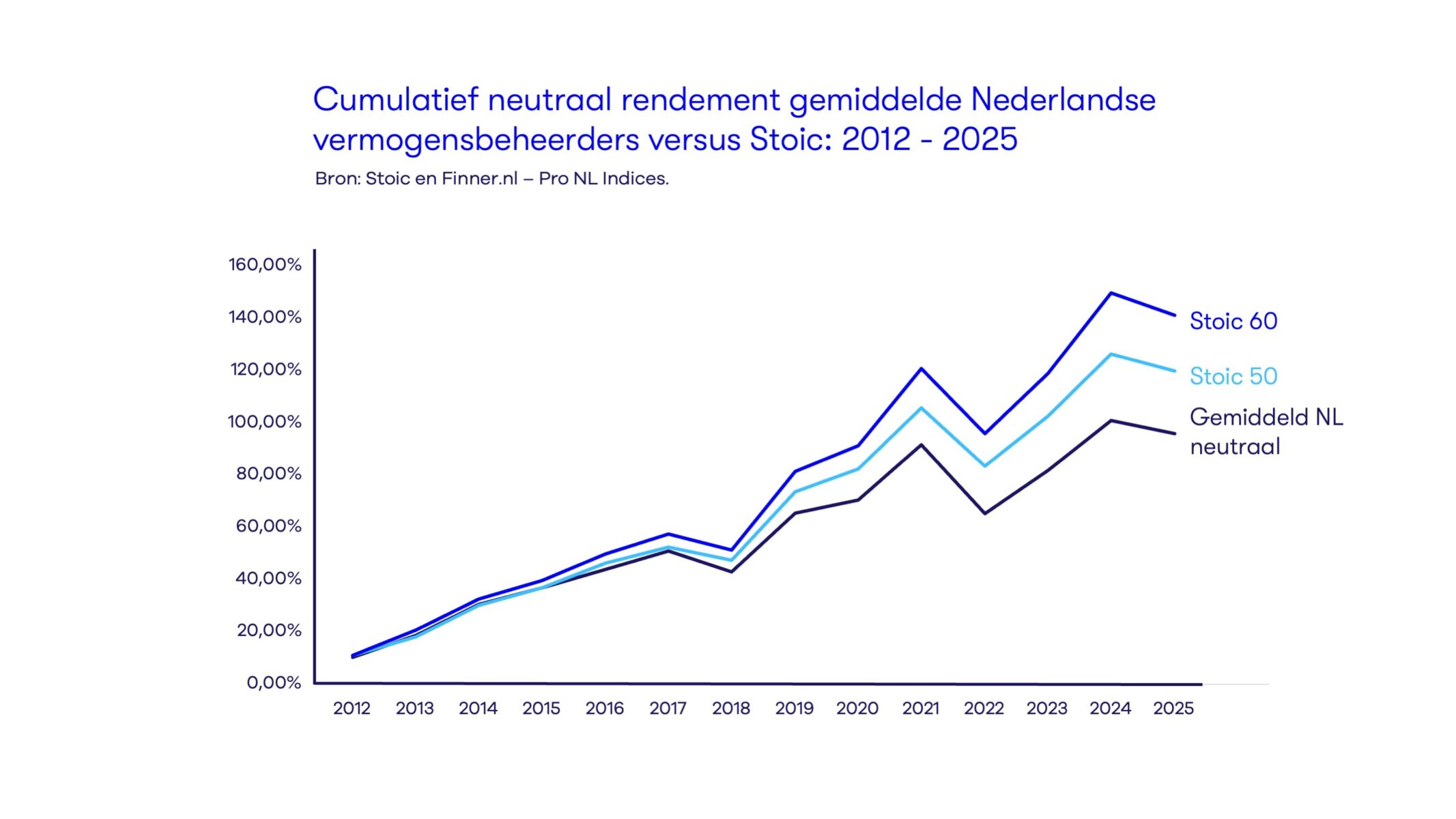

The latter becomes painfully clear when we look at the historical returns. And that is wise to do, because in the end, shares are really about the long term. Finner published the data of the historical development of the neutral profile of the ProNL index since 2012. If we compare this with our own Stoic 50 or Stoic 60 profile (which each consist of 50% and 60% shares respectively), it becomes clear that Stoic performs better in the long term.

In short: is it bad that we underperform a little in the first quarter of 2025?

Our answer: no. As the long-term chart above shows, this is just a snapshot. A drop in the ocean of the long term. At Stoic, we do not base our decisions on gut feelings, but on facts. And they tell us that in the short term, the market moves unpredictably in all directions. If you want to bet on that, then sometimes you are lucky and sometimes you are unlucky. What is much wiser: always focus on the long term. Remain diversified across the entire global economy, remain calm and always invest the bond portion in truly risk-averse bonds. Then everything will always work out in the end. That is what we mean by ‘Calm Capital Control’.