The independent asset management comparison site Finner.nl has also mapped the returns of the average Dutch asset manager up to and including the third quarter of 2022. Falling stock prices are naturally causing losses for everyone. But who knows best how to limit these losses?

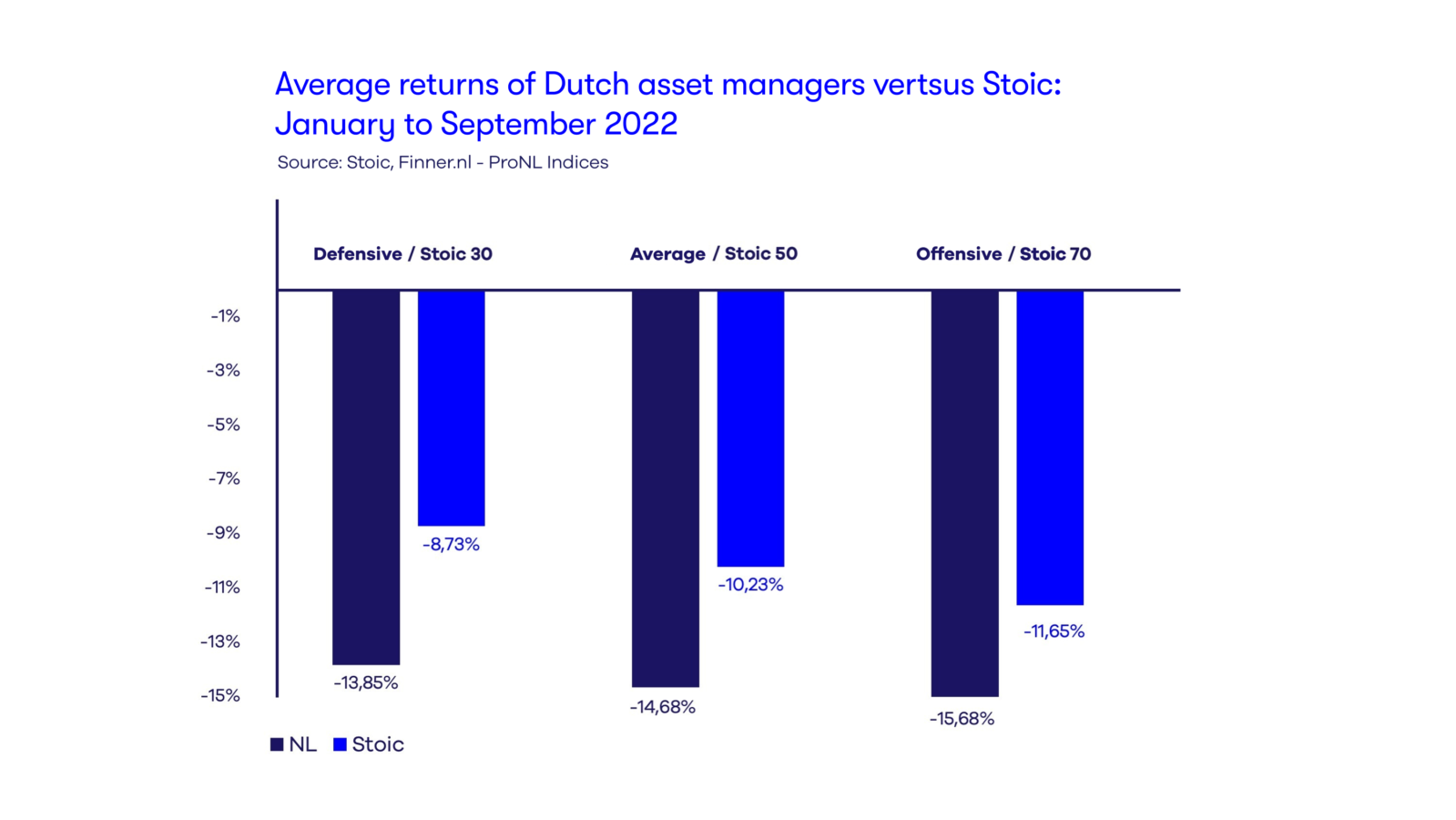

It's becoming a bit of the same story. But even after the end of the third quarter of 2022, it appears that Stoic is better able to limit losses in the current declining stock prices than the average Dutch asset manager, after deducting costs:

(Here you can find the source for this chart.) The difference between Stoic and the rest has actually only widened over the year. In Stoic's favor, that is. Our ultra-passive investment philosophy works. And that's because it's not based on making predictions about the stock market, nor on gut feeling. Our approach is purely based on facts. And they tell us that if you can spare your money for more than 10 years, you can confidently invest it in all stocks worldwide. A stock market recession almost never lasts longer than 10 years. So, in the worst-case scenario, your money will be worth the same after 10 years as it was when you invested. But in the meantime, you'll have benefited from dividend payments and been protected against a loss of purchasing power.

In the current difficult market climate, our advice is to sit tight. After all, prices can bounce around unpredictably in the short term, but the global economy always grows ultimately. We call our asset management approach "Calm Capital Control," and with that, we significantly outperform the average active and passive manager in the Netherlands. Quarter after quarter, the figures prove this. We can't help it. If only everyone would invest ultra-passively.